-

Auditoría de estados financieros

Servicio de Auditoría de estados financieros realizado por la firma contable mexicana Salles Sainz Grant Thornton.

-

Dictamen fiscal

Nuestra gente está comprometida a ofrecer los más altos estándares de excelencia, con integridad, amplios conocimientos técnicos y experiencia comercial.

-

Normas Internacionales de Información Financiera

Ayudamos a nuestros clientes en el proceso de adopción de las Normas Internacionales de Información Financiera.

-

Consultoría y asesoría fiscal

Encontramos las mejores herramientas dentro de las diversas disposiciones fiscales

-

Seguridad social y contribuciones locales

Seguridad social y contribuciones locales

-

Consultoría Fiscal Internacional

Consultoría Fiscal Internacional

-

Prevención y detección de lavado de dinero y prácticas anticorrupción

Prevención y detección de lavado de dinero y prácticas anticorrupción. El Lavado de Dinero es un proceso especializado y con frecuencia complejo de identificar

-

Consultoría de negocios

Comprendemos su organización para ofrecer soluciones que impulsen su negocio orientado a los resultados

-

Tecnología de la información

Basamos nuestra filosofía de trabajo en el conocimiento de negocio de nuestros clientes, atención personalizada y de alta calidad en nuestros servicios.

-

Generador de avisos para actividades vulnerables

Enfocamos esfuerzo y concentración en análisis profundo y decisiones respecto a operaciones sospechosas y a un adecuado cumplimiento de la Ley

-

Consultoría de riesgo

Las empresas de todo el mundo se enfrentan a constantes desafíos en su intento de navegar por la amplia gama de riesgos en complejos mercados globales

-

Consultoría Forense

En tiempos definidos por la incertidumbre y las amenazas a las organizaciones, los profesionales forenses de Grant Thornton han apuntado soluciones para retos difíciles

-

Recuperación y reorganización

Nos centramos en la identificación y resolución de problemas que afectan a la rentabilidad, la protección de valor de la empresa y su recuperación

-

Consultoría Transaccional

Podemos ayudarle a entender los detonantes de valor detrás de transacciones exitosas

-

Prevención y detección de lavado de dinero y prácticas anticorrupción

Certificados por la CNBV en materia de prevención de operaciones con recursos de procedencia ilícita y financiamiento al terrorismo

-

Auditoría Interna

Todas las organizaciones administran el riesgo basándose principalmente en el control interno para ayudar a minimizarlo

-

Auditoría de Cumplimiento al Sistema de Pagos Interbancarios en Dólares (SPID)

Contamos con procedimientos y una metodología para ayudar a las empresas del sector financiero a cumplir con las reglas y procesos operativos

-

Implementación de COUPA – Compras y Gastos

Le proporcionamos una única solución integrada desde compras hasta gastos

-

Servicios para Empresas Familiares

Nuestro equipo está preparado para ayudar a las empresas familiares a crear su protocolo familiar, teniendo experiencia amplia con numerosas familias mexicanas en diferentes estados de la República.

-

Gobierno Corporativo

Salles, Sainz – Grant Thornton, S.C. tiene amplia experiencia en la prestación de servicios de Gobierno Corporativo, basando su filosofía de trabajo en las mejores practicas corporativas, el conocimiento del negocio de nuestros clientes, atención personalizada y de alta calidad en nuestros servicios.

-

Organización, Cultura y Gente

En Salles, Sainz – Grant Thornton, S.C. apoyamos a nuestros clientes a definir y desarrollar sus funciones de capital humano minimizando los riesgos existentes y considerando las dimensiones cambiantes de la fuerza de trabajo.

-

Consultoría de tecnología de la información

Salles Sainz Grant Thornton, S.C. tiene amplia experiencia en Consultoría de Tecnología de Información (TI), basando su filosofía de trabajo en el conocimiento de negocio de nuestros clientes, atención personalizada y de alta calidad en nuestros servicios.

-

Auditoría de Cumplimiento al Sistema de Pagos Interbancarios en Dólares (SPID)

El área de Business Advisory Services presta servicios de consultoría integral en diversas materias como TI, operativa, ISO, entre muchos otros, lo cual nos ha permitido tener una experiencia sólida en diversos sectores incluyendo el financiero.

-

Implementación de COUPA - Compras y Gastos

En Salles Sainz Grant Thornton, S.C., entendemos cuales son los elementos que requieren las organizaciones para afrontar los retos que demanda una administración eficiente de compras y gastos y cómo podemos ayudarle a la mejora de la gestión de las compras y gastos

-

Administración de riesgos

El área de Business Advisory Services de Salles, Sainz – Grant Thornton, S.C. apoya a las organizaciones en la conexión del pensamiento de riesgo con su negocio u objetivos estratégicos, así como la actividad de gestión cotidiana.

-

Valuaciones, fusiones y adquisiciones

El área de Business Advisory Services de Salles, Sainz – Grant Thornton, S.C. ayudamos a nuestros clientes a navegar transacciones complejas - ya sea comprando o vendiendo - con velocidad y agilidad, desde el diseño de la estrategia de la transacción hasta el desarrollo del due diligence y la integración de un nuevo negocio o la separación de una entidad, apoyamos a nuestros clientes a aprovechar oportunidades, resolver problemas y administrar riesgos para liberar su potencial de crecimiento.

-

Control Interno

En Salles, Sainz – Grant Thornton, S.C. trabajamos con entidades de diversos tamaños y sectores. Optimizamos los esfuerzos para alcanzar sus objetivos con la aplicación de los estándares y metodologías más elevadas de Control Interno, Administración y Gestión de Riesgos.

-

Investigaciones Forenses y Disputas

Combinando técnicas y habilidades de investigación avanzadas, métodos de tecnología forense y un amplio conocimiento de la industria, Salles, Sainz – Grant Thornton, S.C. cuenta con profesionales especializados que ayudan a nuestros clientes y sus consejeros legales investigando las acusaciones de fraude y a responder ante los accionistas y autoridades.

-

Contraloría externa

Factor clave en su estrategia de administración de negocios, ya que es una herramienta efectiva que potencia los beneficios de la pequeña y mediana empresa

-

Capital Humano

Proveemos soluciones para su empresa para encontrar y retener el talento en ella.

Business leaders renew appeal for clarity on 'acceptable' tax planning

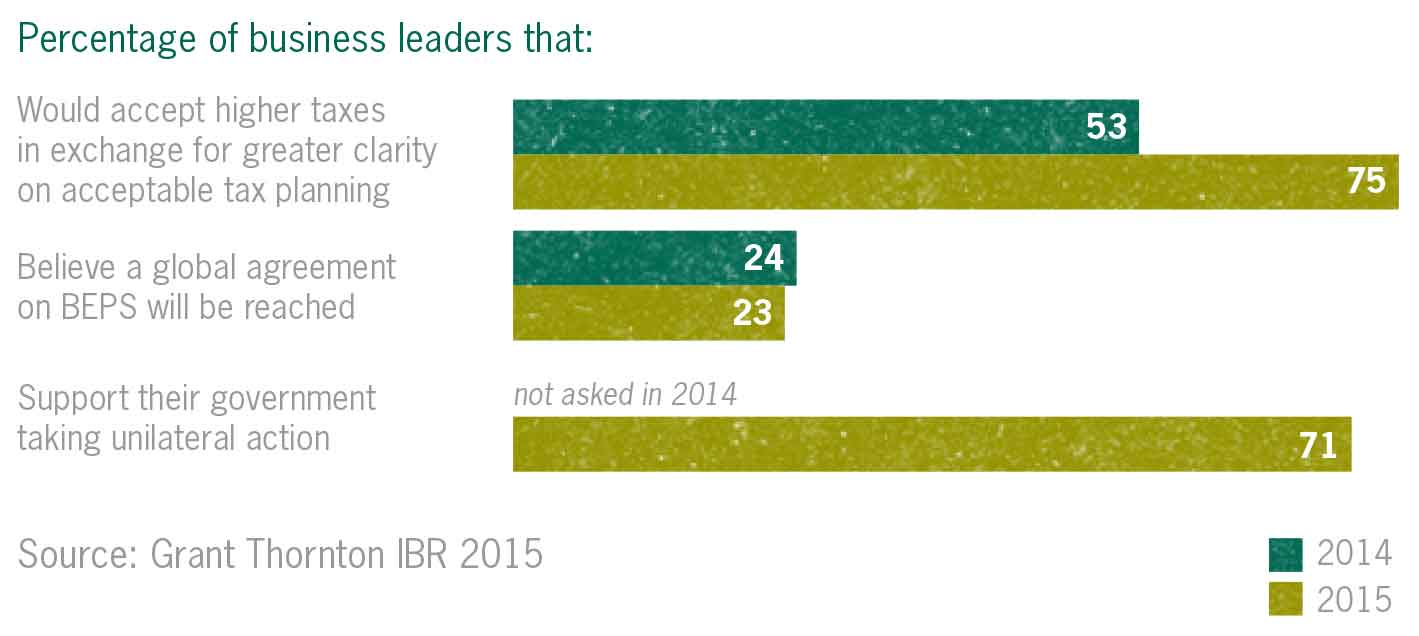

Three quarters of business leaders would pay more taxes in exchange for greater clarity from authorities on what is acceptable, according to the Grant Thornton International Business Report (IBR), a global survey of 2,580 businesses in 35 economies. And while few expect a global agreement any time soon, the majority would like to see their governments take unilateral action to help achieve this aim.

Francesca Lagerberg, global leader for tax services at Grant Thornton said: “The levels of taxation paid by businesses has become a very public and emotive issue. But setting emotion to one side, businesses have a responsibility to their investors and shareholders to keep costs down - within the existing regulatory parameters."

"Despite this, our IBR survey clearly shows that the vast majority would actually support paying more in tax in exchange for clearer guidance from tax authorities on what is acceptable tax planning. The ball is very firmly in their court to provide the clear lines that businesses are requesting. The results provide more evidence that clarity is needed in the complex world of cross border tax transactions."

When asked if they would welcome more global co-operation and guidance from tax authorities on what is acceptable and unacceptable tax planning, even if this provided less opportunity to reduce tax liabilities across borders, 75% of business leaders said 'Yes', up from 53% one year earlier.

In the G7, 75% want greater clarity, up from 43% one year earlier. Notable countries were India (95%), South Africa (94%, up from 64%) the UK (83% up from 59%) and US (83%, up from 37%).

Unilateral vs multilateral

Business leaders are not hopeful that a global agreement will be enacted to provide clearer tax rules for all. Just 23% of the survey respondents thought that the OECD's plans on global tax improvement under the Base Erosion and Profit Shifting project (BEPS) would be successfully implemented. This is slightly down from 24% one year earlier.

However, they are far more supportive of unilateral, individual country, action in lieu of a global agreement: 71% said they would support their own government taking unilateral action to combat the loss of tax revenue in their jurisdiction. Support for local action is strongest in India (95%), the US (82%), UK (79%), China (67%) and Ireland (64%).

Francesca Lagerberg continued: "Businesses may be pessimistic on the chances of a global agreement - the Doha Round and climate change negotiations have taught us that these things take time. However, the work being undertaken by the OECD on tax planning should go some way to allaying business concerns by moving this debate away from talk to action. The OECD is set to finalise its recommendations this year.

"International tax standards clearly need to be stripped down and rebuilt for the world we live in today. The existing legislation is creaking at the seams in an increasingly interconnected, digital world in which the definition of a 'border' is looking archaic. The research is showing that businesses are asking for more help to enable them to navigate the new challenges of a digital economy.”

- ends -

John Vita, Director - PR

Find out more about the IBR survey and explore the full data for global business optimism.